The Family Office, a leading wealth management company in the GCC, is proud to announce the launch of its new Marketplace. The platform offers clients the ability to buy and sell illiquid assets with ease, providing increased liquidity options for their private market portfolios. With a focus on diversified alternatives such as private equity, private debt, real estate, and more, investors can now take control of their investments like never before.

The latest addition to the wealth management services of The Family Office revolutionizes private market investments in the GCC, allowing clients greater flexibility and control over their illiquid investments. At the click of a button, clients can manage the concentration of their portfolio or exit from their deals early should they need liquidity.

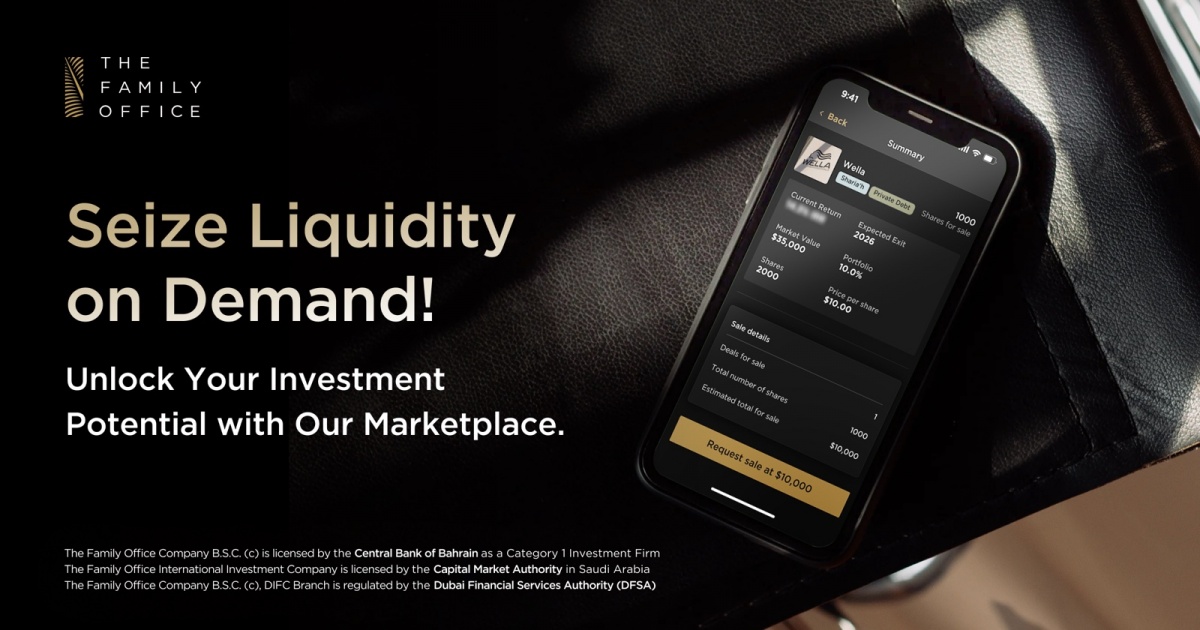

Sellers on the Marketplace can list their deals by specifying the number of shares they wish to sell and the desired price per share. Investors, on the other hand, can bid on listed opportunities by setting the number of shares and the price per share they are willing to pay. This dynamic bidding process ensures a fair and transparent marketplace for all participants.

Click here to connect with our financial advisors and learn more about the Marketplace.

About The Family Office

The Family Office in Bahrain, Dubai and its Riyadh-based wealth manager, The Family Office International Investment Company, are regulated by the Central Bank of Bahrain, The Dubai Financial Services Authority and the Capital Market Authority of Saudi Arabia, serving hundreds of families, individuals and investors. The firm helps clients achieve their wealth goals through custom-made investment strategies that cater to their unique needs.

Disclaimer

The Family Office Co. BSC (c) is a Category 1 Investment Firm regulated by the Central Bank of Bahrain C.R. No. 53871 dated 21/6/2004. Paid Up Capital: US$10,000,000. The Family Office Co. BSC (c) only offers products and services to ‘accredited investors’ as defined by the Central Bank of Bahrain.

The Family Office International Investment is a joint stock closed company owned by one person. Paid-up capital SR20 million. CR No. 7007701696. Licensed by the Capital Market Authority (no. 17-182-30) to carry out arranging, advisory and managing investments and operating funds, with respect to securities.

The Family Office Company B.S.C. (c), DIFC Branch is a recognized company in the Dubai International Financial Centre (DIFC) under registration number 6567 and regulated by the Dubai Financial Services Authority (DFSA). The Family Office Company B.S.C. (c), DIFC Branch is not permitted to deal with Retail Clients (as defined in DFSA’s Conduct of Business Module).